It’s never been so tough for financial services to get the numbers.

Things like cost-to-income ratios are generally up. Loan volumes are up as well but there’s been a trend of rising non-performing loan (NPL) stock, reportedly up from 2.84% in 2017 to 5.18% in 2020. Regulation is also up.

The problem is you can only cut costs so much, regulation adds overhead, and there’s a complexity to markets and customers that won’t quiet down. If anything, rampant access to data has made things worse. We don’t always need more data.

Sometimes we need better data that’s more relevant so we can find new opportunities, new ways to serve customers, new ways to help the burgeoning teams of data scientists, product managers, marketers, and all the other people dedicated to turning things around and staying the path.

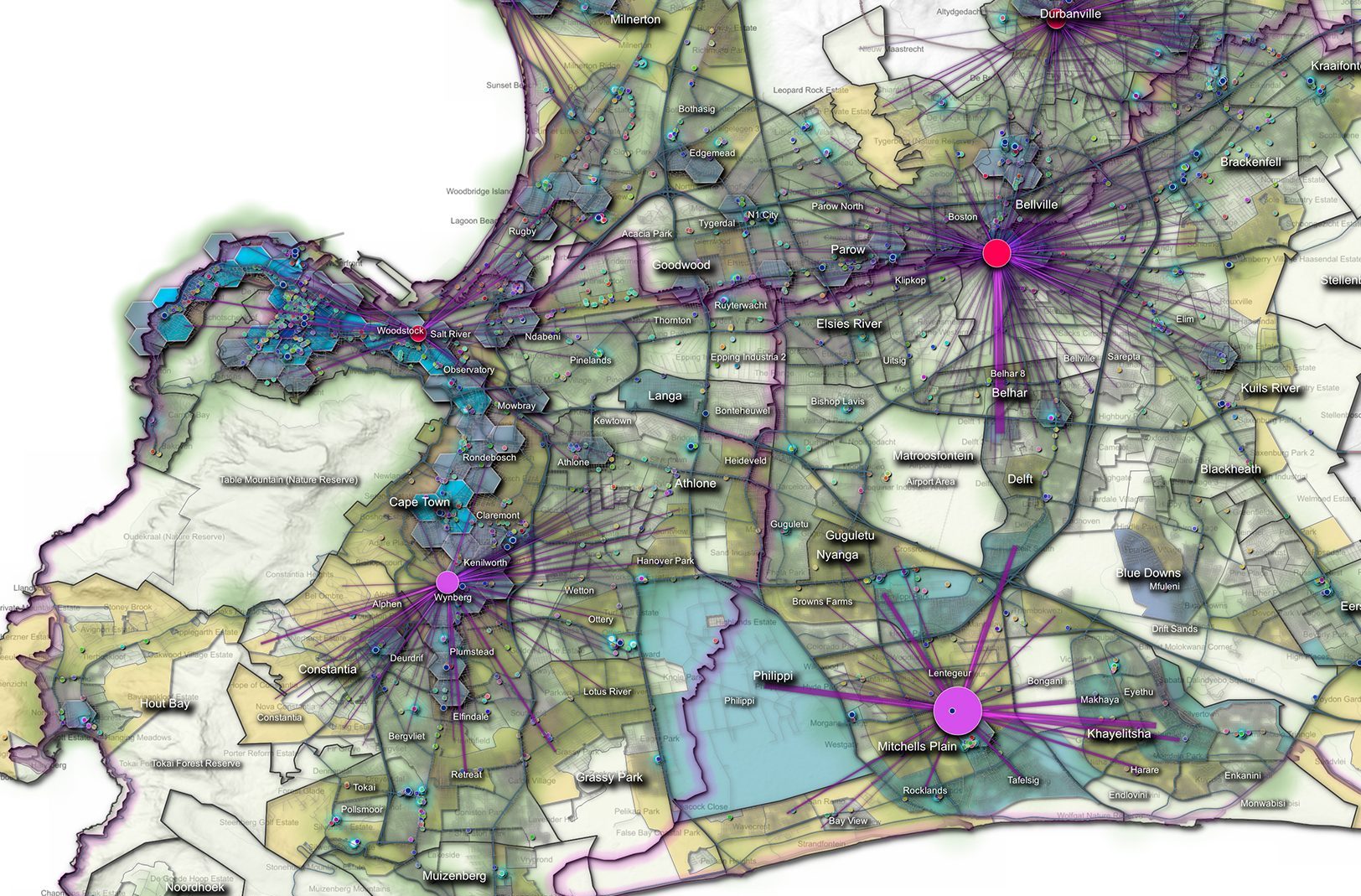

Banks used to use GIS data to manage ATM networks. But these days they use enriched location-intelligence to make more money, by helping their employees make smarter decisions, and by being much more relevant to customers.

Solving the challenge

Customers are complex. They don’t always live where they say they do. They fib for various reasons, not least being prestige and status. That can be a bit of a problem when trying to figure out who’s riskier and who’s not, who can be offered preferential rates, who needs collateral, insurance, or perhaps other innovative products to see them through.

There’s a raft of people in financial services who need to know interesting things about the business, the customers, the performance of products, services, infrastructure and more. It’s not all about the board and their execs, although they deserve a shout, of course. Propping up the whole shebang are, for instance, branch managers, who could benefit from better intelligence about their patch.

They perpetually hunger for information about residential, retail, and industrial growth to identify prospects and help them meet targets. Segment and product development teams crave information about complex and evolving customer demographics, by area, over time.

If you feed them accurate, relevant location intelligence and insights using verified and validated address data, they improve their output quality, more frequently meet customer expectations, and more often meet their obligations.

What’s the catch?

The caveat is that you need verified and validated data from authoritative sources you can rely on to enrich your own information. It’s the basic fundamental to improve the success of experimentation in minimum viable products (MVP). It’s how we forecast dependably, plan efficiently, streamline overheads, adapt our services, and get in on new markets when they’re still plump.

This is a far cry from crowd-sourced map data that seems apparently free and easy. We all know there’s no such thing as a free lunch.

Location intelligence, insights and analytics, in other words geospatial information science has become a game-changer because we have been refining it over more than 20 years using our verified and validated address data.

Prominent South African banks use it to match credit profiles to property prices, accurately locate applications geographically, to reduce default risk and attract more business. They give better customer experiences and better rates, and they get more bankable business as a result.

How you can play too

Just because it needs data enriched with verified and validated sources does not mean this takes an arm and a leg with a swarm of propeller heads. It’s in the cloud, so you connect in ways that are now standard. Your customer data is still your own and you have full control. Plus, the cost is clear. There’s no attempt to conceal micro fees that quickly get out of control based on little more than tricky grammar about keystrokes.

It’s quick, cost-effective, highly informative, accessible and integrated via standard APIs, more secure, and delivers more business benefits faster than ever before. This is the kind of disruptive experience that helps financial services scale disruptive experiences of their own.

About AfriGIS

AfriGIS is the leading Geospatial Information Science company in Southern Africa that specialises in location-sensitive data and solutions. It provides customers across the board with a suite of web-based tools and APIs to connect to, enhance, and enrich their own data with location intelligence, insights, and trusted data. The organisation was founded in 1997 and celebrates 25 years in business this year. It is a level 1-certified broad-based black economic empowerment (B-BBEE) business, with more than 100 employees, in Pretoria, Durban and Cape Town in South Africa, Dublin in Ireland, and Dhaka in Bangladesh.

Media enquiries:

Lydette Fouche, AfriGIS

Contact details: +27 (0) 87-310-6400, lydette@afrigis.co.za

Irene Masia, AfriGIS

Contact details: +27 (0) 87-310-6400, irene@afrigis.co.za

Issued by: Michelle Oelschig, Scarlet Letter

Contact details: +27 (0) 83-636-1766, michelle@scarletletter.co.za